1 引言

期权定价模型[1]是目前为止对于期权定价最成功的模型, 其假定股票价格的变动由几何布朗运动描述. 但是, 对金融数据的实证研究已经表明, B-S期权定价模型不能很好的描述价格变化的一些特征, 诸如: 常值周期性、长相依性、厚尾倾斜的边缘分布等.

由于分数布朗运动可以描述资产价格长相依性的特征, 所以一些学者将B-S期权定价模型中的布朗运动替换为分数布朗运动, 进而得出了各类期权的定价公式. 但由于分数型的B-S定价公式已被证明在一个完备且无摩擦的市场上会产生套利[2], 为了解决套利的问题以及体现资产价格变动过程中长相依性的特征, Cheridito[3]建议使用混合分数布朗运动去描述金融资产价格的变动. Cheridito已经证明, 当Hurst指数

因此, 为了描述资产价格变动过程中出现的常值周期性、长相依性的特征, Magdziarz[4]引入时变几何布朗运动描述资产价格的变动, 获得了时变几何布朗运动下的欧式期权定价公式, 并证明了他所采用的定价模型是无套利的. 时变过程, 在通俗意义上讲就是将随机过程状态发生的时间仍视为一个随机过程, 从而形成一个复合随机过程. 此后, Gu等[5]研究了时变几何分数布朗运动下带有交易成本的欧式期权定价问题, 得到了欧式期权的定价公式; Guo等[6]得到了时变混合分数布朗运动下欧式期权的定价公式; Shokrollahi等[7]研究了时变混合分数布朗运动下带有交易成本的欧式期权以及货币期权的定价问题, 得到了相应的定价公式; Shokrollahi[8]得到了当股票价格由时变混合分数布朗运动描述时几何平均亚式期权的定价公式, 并且获得了在一些特殊情形下亚式期权价格的下界.

以上关于时变情形下的定价模型大多集中于对于欧式期权的研究, 在对亚式期权定价研究中, 已有文献很少考虑到标的资产价格变动过程中呈现的常值周期性的特征. 另外, 已有关于亚式期权的定价模型也很少考虑标的资产交易过程中的交易成本, 这与金融市场实际不符. 因此, 为了体现资产价格变动的常值周期性、长相依性以及交易过程中产生的交易成本, 该文考虑时变混合分数布朗运动下带交易费用的几何平均亚式期权定价问题. 行文结构如下: 第二部分给出了相关的预备知识; 第三部分给出了期权定价模型以及几何平均亚式看涨期权价格所满足的偏微分方程; 第四部分推出了几何平均亚式看涨、看跌期权的定价公式; 第五部分为数值试验; 第六部分为实证分析; 第七部分为结论.

2 预备知识

本节给出时变过程的相关概念、性质以及基本结论.

为逆

1)

2)

其中

为时变混合分数布朗运动.

下面给出复合过程

引理2.1[5] 对于

1)

2)

3)

进一步, 对于

1)

2)

3)

下面给出时变过程矩的一些重要结论.

1)

2)

3)

4)

3 定价模型

为了得到在离散情形下带有交易成本的几何平均亚式看涨期权的定价公式, 需要对金融市场做如下几点基本的假设.

1) 标的资产(股票)在时刻

其中

2) 在离散的时间点

3) 买卖股票时需支付一定的交易成本, 即在股价为

4) 股票无红利支付, 所有证券完全可分, 允许卖空.

5) 期权的价值可通过一个含有

其中

基于上述假设, 推导在时间区间

定理3.1 假设在时刻

其中

证 在长度为

其中

因此, 对于

其中

由(3.4)–(3.7)式以及引理2.1得

那么

对

由(3.6)式以及文献[5], 可以验证

由假设3)以及假设5), 投资组合

其中

由假设2)以及假设5),

取

根据(3.10)式以及(3.15)式得

由(3.16)式以及假设5)得

再根据引理2.4以及文献[7]可得

对于没有交易成本的普通欧式看涨期权, 总有

从而

又因

定理3.1证毕.

4 模型求解

定理4.1 假设在时刻

其中

证 类似于文献[12]中的方法, 令

由(4.2)式以及(4.3)式可得

将上述变换带入(3.3)式, 得

令

其中

将(4.6)式带入(4.4)式, 得

再令

结合终止条件

在变换(4.5)下, (4.4)式转变为热传导方程的Cauchy问题

其解可以表示成Poission公式, 即

由变换(4.2)式、(4.3)式以及(4.5)式, 回到原变量以及函数

其中

定理4.1证毕.

推论4.1 假设在时刻

其中

证 由边界条件

5 数值试验

表 1 不同亚式期权定价模型价格之间的比较

| K | C_{GBM} | C_{FBM} | C_{MFBM} | C_{TC-MFBM} |

| 90 | 12.818953 | 12.689548 | 13.990609 | 13.192214 |

| 91 | 12.081619 | 11.928910 | 13.335705 | 12.412176 |

| 92 | 11.366589 | 11.190936 | 12.699837 | 11.636384 |

| 93 | 10.674784 | 10.476815 | 12.083259 | 10.864681 |

| 94 | 10.007019 | 9.787618 | 11.486168 | 10.096917 |

| 95 | 9.363990 | 9.124284 | 10.908701 | 9.332946 |

| 96 | 8.746270 | 8.487611 | 10.350937 | 8.572629 |

| 97 | 8.154301 | 7.878242 | 9.812900 | 7.815831 |

| 98 | 7.588394 | 7.296662 | 9.294556 | 7.062422 |

| 99 | 7.048728 | 6.743191 | 8.795820 | 6.312278 |

| 100 | 6.535349 | 6.217986 | 8.316557 | 5.565279 |

各定价公式中一些参数取值如下: 无风险利率

各模型基本情况统计, 结果见表 2.

表 2 各模型基本情况统计

| C_{GBM} | C_{FBM} | C_{MFBM} | C_{TC-MFBM} | |

| 均值 | 9.489636 | 9.256528 | 11.00682 | 9.351251 |

| 最大值 | 12.81895 | 12.68955 | 13.99061 | 13.19221 |

| 最小值 | 6.535349 | 6.217986 | 8.316557 | 5.565279 |

| 中位数 | 9.36399 | 9.124284 | 10.9087 | 9.332946 |

| 标准差 | 2.089258 | 2.152659 | 1.884268 | 2.529078 |

对于本文所得的几何平均亚式看涨期权的定价公式(4.1), 其中的参数

图 1

由表 1可知, 基于不同定价模型的几何平均亚式看涨期权定价公式得到的期权价格没有特别显著的差异, 但与其它亚式期权定价公式给出的价格相比, 时变混合分数布朗运动下带有交易成本的定价公式得到的期权价格随着行权价格的升高, 期权价格具有更快的衰减速度, 这与交易过程中产生的交易费用相对应, 更低的价格是对交易成本累积的惩罚, 与金融市场流动性理论相一致. 图

6 实证分析

6.1 参数求解

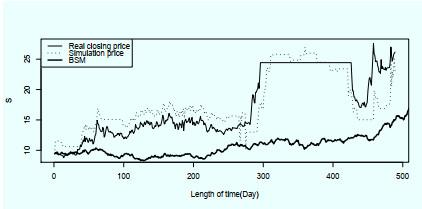

选取万科2014年10月8日至2016年9月30日的收盘价(数据来源于"yahoo") 来验证模型(3.1)在描述具有常值周期性特征的资产价格变动时是否具有有效性. 在选取的时间段上股价变动如图 2所示.

图 2

从中可以明显的看到在选取的时间区间内, 万科股价的变动显示出了类似于“常值周期性”的特征, 因此可以考虑运用模型(3.1)来描述这种变动.

首先运用历史数据估计股票价格的波动率以及运用

波动率的估计式如下

其中

转变为年波动率, 计算可得万科股票价格的年波动率为

运用

其中

其中

6.2 模型有效性分析

取万科2014年10月8日的收盘价9.44元作为初始值

图 3

表 3 误差分析表

| 均值 | 最大值 | 最小值 | 中位数 | 标准差 | 极差 | |

| 收盘价 | 17.41 | 27.57 | 8.78 | 14.67 | 5.44 | 18.79 |

| 模拟价 | 17.63 | 27.00 | 9.44 | 16.22 | 4.55 | 17.56 |

| BSM | 17.57 | 31.47 | 8.28 | 15.63 | 7.56 | 23.19 |

由图

7 结论

通过假设标的资产(股票)价格变动服从时变混合分数布朗运动, 得到了在离散情形下带有交易成本的几何平均亚式看涨、看跌期权的定价公式. 基于数值试验, 对不同亚式期权定价公式得到的期权价格进行了比较, 发现本文所获得的定价公式更能体现出标的资产交易过程中产生的交易费用对期权价格的影响, 并且定价公式中的参数

参考文献

The pricing of option and corporate liabilities

Arbitrage in fractional Brownian motion models

DOI:10.1007/s007800300101 [本文引用: 1]

Mixed fractional Brownian motion

Black-Scholes formula in subdiffusive regime

DOI:10.1007/s10955-009-9791-4 [本文引用: 1]

Time-changed geometric fractional Brownian motion and option pricing with transaction costs

DOI:10.1016/j.physa.2012.03.020 [本文引用: 7]

Pricing European option under the time-changed mixed Brownian-fractional Brownian model

DOI:10.1016/j.physa.2014.03.032 [本文引用: 2]

Pricing European options and currency options by time changed mixed fractional Brownian motion with transaction costs

The evaluation of geometric Asian power options under time changed mixed fractional Brownian motion

DOI:10.1016/j.cam.2018.05.042 [本文引用: 1]

Evaluation of geometric Asian power options under fractional Brownian motion

DOI:10.4236/jmf.2014.41001 [本文引用: 1]

Pricing geometric Asian power options under mixed fractional Brownian motion environment

DOI:10.1016/j.physa.2015.11.013 [本文引用: 1]

基于时间变换和分数型过程下的期权定价及模拟分析

Option pricing and simulation analysis based on time transformation and fractional process

在跳环境和混合高斯过程下的资产定价及模拟

Asset pricing and simulation under the environment of jumping and mixed gaussian process