数学物理学报 ›› 2019, Vol. 39 ›› Issue (3): 649-663.

跳-扩散模型下期权定价方法及参数校准

- 1 中国人民大学数学学院 北京 100872

2 石家庄铁路职业技术学院 石家庄 050041

Option Pricing Method and Parameter Calibration for Jump-Diffusion Model

Congcong Xu1,2,Zuoliang Xu1,*( )

)

- 1 School of Mathematics, Renmin University of China, Beijing 100872

2 Shijiazhuang Institute of Railway Technology, Shijiazhuang 050041

摘要:

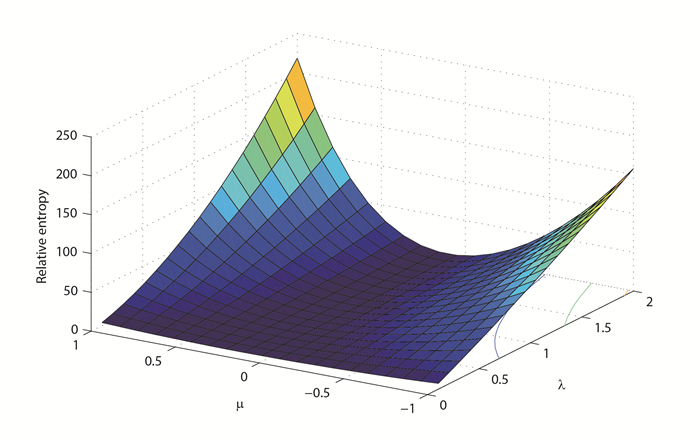

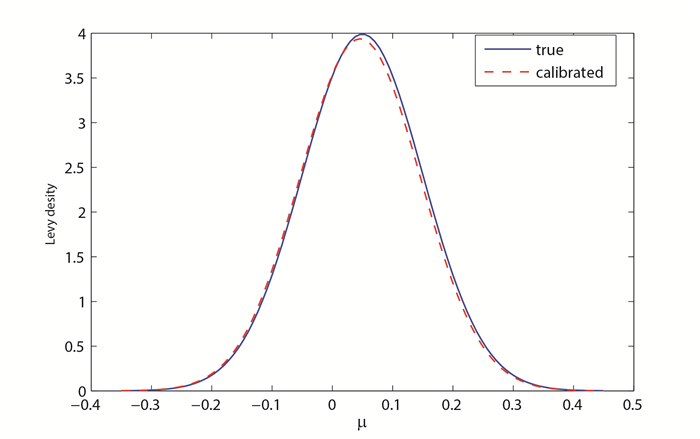

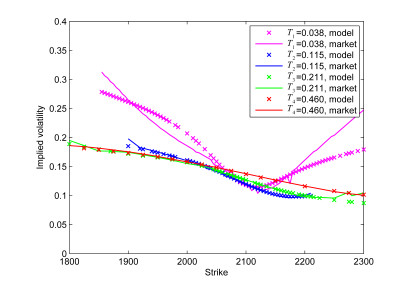

该文对跳-扩散模型下期权定价方法及参数校准问题进行研究.首先,推导出了跳-扩散模型在均值修正等价鞅测度下的风险中性特征函数,利用COS方法对跳-扩散模型进行期权定价,分析了COS方法的定价误差,并通过数值实验验证了COS定价方法的有效性;然后,采用相对熵正则化方法对跳-扩散模型进行参数校准,通过数值模拟实验验证了校准方法的准确性和可靠性;最后,利用S&P500市场数据对模型参数进行校准.结果表明:不同到期日期权数据校准结果有很大不同,Merton跳-扩散模型比Black-Scholes模型能更好的模拟市场数据.

中图分类号:

- O211.6