Acta mathematica scientia,Series A ›› 2023, Vol. 43 ›› Issue (6): 1843-1854.

Previous Articles Next Articles

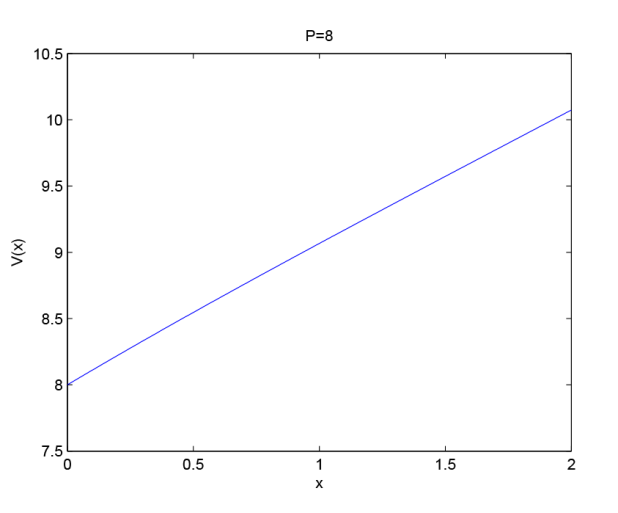

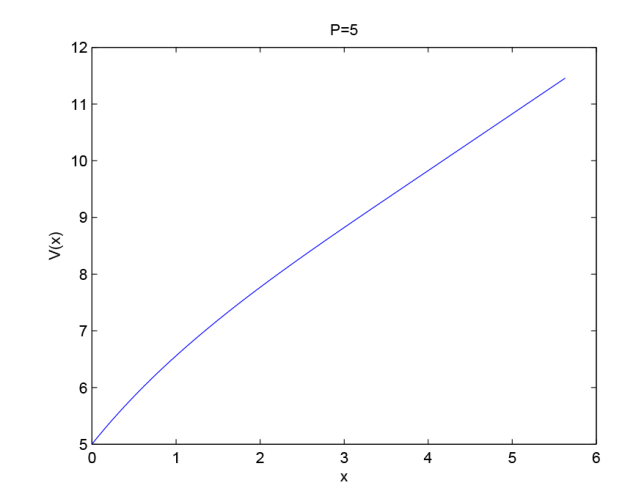

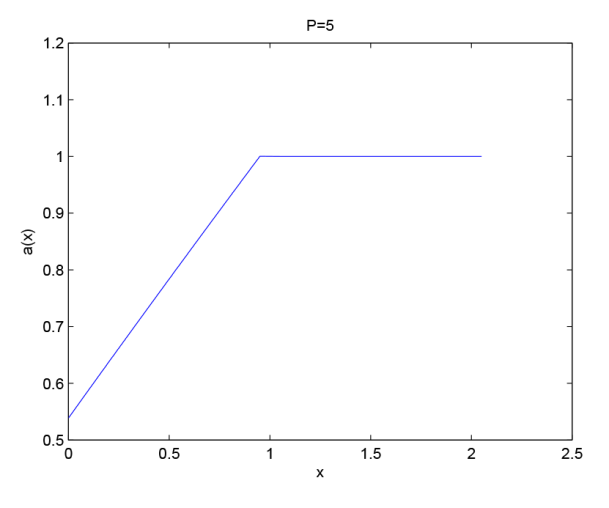

Maximizing Insurer's Firm Value by Dividend and Reinsurance with a Random Time Horizon

Liu Xiao( ),Ye Yangshuai(

),Ye Yangshuai( ),Xu Lin*(

),Xu Lin*( )

)

- School of Mathematics and Statistics, Anhui Normal University, Anhui Wuhu 241003

-

Received:2021-11-16Revised:2022-10-18Online:2023-12-26Published:2023-11-16 -

Supported by:NSFC(11971034);Education of Humanities and Social Science Fund Project(17YJC910009);Natural Science Foundation of Anhui Province(1908085MA21)

CLC Number:

- O212.62

Cite this article

Liu Xiao, Ye Yangshuai, Xu Lin. Maximizing Insurer's Firm Value by Dividend and Reinsurance with a Random Time Horizon[J].Acta mathematica scientia,Series A, 2023, 43(6): 1843-1854.

share this article

| [1] | Albrecher H, Thonhauser S. On optimal dividend strategies in insurance with a random time horizon//Cohen S N, Modan D, Siu T K, Yang H L. Stochastic Processes, Finance and Control: A Festschrift in Honor of Robert J Elliott. Singapore: World Scientific, 2012: 157-179 |

| [2] | Bai L H, Ma J, Xing X J. Optimal dividend and investment problems under Sparre Andersen model. Annals of Applied Probability, 2017, 27(6): 3588-3632 |

| [3] |

Cai J, Gerber H U, Yang H L. Optimal dividends in an Ornstein-Uhlenbeck type model with credit and debit interest. North American Actuarial Journal, 2006, 10(2): 94-108

doi: 10.1080/10920277.2006.10596250 |

| [4] |

Chen A, Hieber P. Optimal asset allocation in life insurance: The impact of regulation. Astin Bulletin, 2016, 46(3): 605-626

doi: 10.1017/asb.2016.12 |

| [5] |

Chen M, Peng X F, Guo J Y. Optimal dividend problem with a nonlinear regular-singular stochastic control. Insurance Mathematics and Economics, 2013, 52(3): 448-456

doi: 10.1016/j.insmatheco.2013.02.010 |

| [6] |

Cheng G P, Zhao Y X. Optimal risk and dividend strategies with transaction costs and terminal value. Economic Modelling, 2016, 54: 522-536

doi: 10.1016/j.econmod.2016.01.009 |

| [7] | Feng Y, Zhu J, Siu T K. Optimal risk exposure and dividend payout policies under model uncertainty. Insurance: Mathematics and Economics, 2021, 100(9): 1-29 |

| [8] | Guan G H, Liang Z X. Optimal reinsurance and investment strategies for insurer under interest rate and inflation risks. Insurance: Mathematics and Economics, 2014, 55(3): 105-115 |

| [9] |

Jgaard B H, Taksar M. Controlling risk exposure and dividends payout schemes: Insurance company example. Mathematical Finance, 1999, 9(2): 153-182

doi: 10.1111/mafi.1999.9.issue-2 |

| [10] |

Paulser J. Optimal dividend payouts for diffusions with solvency constraints. Finance and Stochastics, 2003, 7(4): 457-473

doi: 10.1007/s007800200098 |

| [11] |

Liang Z X, Huang J P. Optimal dividend and investing control of a insurance company with higher solvency constraints. Insurance Mathematics and Economics, 2010, 49(3): 501-511

doi: 10.1016/j.insmatheco.2011.08.008 |

| [12] | Lin H, Liang Z X. Optimal dynamic asset allocation strategy for ELA scheme of DC pension plan during the distribution phase. Insurance: Mathematics and Economics, 2013, 52(2): 404-410 |

| [13] |

Meng H, Zhou M, Siu T K. Optimal dividend-reinsurance with two types of premium principles. Probability in the Engineering and Informational Sciences, 2016, 30(2): 224-243

doi: 10.1017/S0269964815000352 |

| [14] |

Taksar M I. Optimal risk and dividend distribution control models for an insurance company. Mathematical Methods of Operations Research, 2000, 51(1): 1-42

doi: 10.1007/s001860050001 |

| [15] |

Wang W, He J. Optimality of barrier dividend strategy in a jump-diffusion risk model with debit interest. Periodica Mathematica Hungarica, 2020, 82(2): 39-55

doi: 10.1007/s10998-020-00338-x |

| [16] |

Wei J Q. Optimal reinsurance and dividend strategies under the Markov-modulated insurance risk model. Stochastic Analysis and Applications, 2010, 28(6): 1078-1105

doi: 10.1080/07362994.2010.515488 |

| [17] |

Xu J F, Zhou M. Optimal risk control and dividend distribution policies for a diffusion model with terminal value. Mathematical and Computer Modelling, 2012, 56(7/8): 180-190

doi: 10.1016/j.mcm.2011.12.041 |

| [18] |

Xu R, Wang W, Garrido J. Optimal dividend strategy under Parisian ruin with affine penalty. Methodology and Computing in Applied Probability, 2022, 24: 1385-1409

doi: 10.1007/s11009-021-09865-7 |

| [19] |

Yao D J, Yang H L, Wang R M. Optimal risk and dividend control problem with fixed costs and salvage value: Variance premium principle. Economic Modelling, 2014, 37(2): 53-64

doi: 10.1016/j.econmod.2013.10.026 |

| [20] |

Yao D J, Yang H L, Wang R M. Optimal dividend and reinsurance strategies with financing and liquidation value. Astin Bulletin, 2016, 46(2): 365-399

doi: 10.1017/10.1017/asb.2015.28 |

| [21] |

Yin C C, Wen Y Z. Optimal dividend problem with a terminal value for spectrally positive Lévy processes. Insurance Mathematics and Economics, 2013, 53(3): 769-773

doi: 10.1016/j.insmatheco.2013.09.019 |

| [22] |

Zhao Y X, Wang R M, Yao D J, Chen P. Optimal dividends and capital injections in the dual model with a random time horizon. Journal of Optimization Theory and Applications, 2015, 167(1): 272-295

doi: 10.1007/s10957-014-0653-0 |

| [1] | Huang ,Liu Haiyan,Chen Mi. Proportional Reinsurance and Investment Based on the Ornstein-Uhlenbeck Process in the Presence of Two Reinsurers [J]. Acta mathematica scientia,Series A, 2023, 43(3): 957-969. |

| [2] | Kunpeng Ji,Xingchun Peng. Optimal Investment and Reinsurance Strategies for Loss-averse Insurer Considering Inflation Risk and Minimum Performance Guarantee [J]. Acta mathematica scientia,Series A, 2022, 42(4): 1265-1280. |

| [3] | Mi Chen,Changwei Nie,Haiyan Liu. Randomized Dividends in a Discrete Risk Model with Time-Correlated Claims [J]. Acta mathematica scientia,Series A, 2022, 42(2): 631-640. |

| [4] | Yuying Zhao,Yuzhen Wen. Optimal Investment and Proportional Reinsurance Strategies to Minimize the Probability of Drawdown Under Ambiguity Aversion [J]. Acta mathematica scientia,Series A, 2021, 41(4): 1147-1165. |

| [5] | Xiao Liu,Peng Yao,Zhenlong Chen. On Optimal Dividend and Reinsurance Problems in the Diffusion Risk Model with Random Time Horizon [J]. Acta mathematica scientia,Series A, 2021, 41(2): 538-547. |

| [6] | Xiaoxiao Zhang,Hua Dong. Dividend Problem with Parisian Delay for the Classical Risk Model with Debit Interest [J]. Acta mathematica scientia,Series A, 2019, 39(5): 1272-1280. |

| [7] | You Lingyun, Tan Jiyang, Li Ziqiang, Zhang Hanjun. Optimal Dividend Strategy in Compound Binomial Dual Model with Bounded Dividend Rates and Periodic Dividend Payments [J]. Acta mathematica scientia,Series A, 2017, 37(4): 751-766. |

| [8] | Chen Xu, Yang Xiangqun. Optimal Dividend-Payout in a MAP Risk Model [J]. Acta mathematica scientia,Series A, 2016, 36(1): 176-186. |

| [9] | Yang Long. The Risk Process with Dependence Based on FGM Copula under A Multi-Layer Dividend Strategy [J]. Acta mathematica scientia,Series A, 2015, 35(5): 1004-1017. |

| [10] | CHEN Mi, GUO Jun-Yi. Optimal Investment and Proportional Reinsurance under Exponential Premium Calculation [J]. Acta mathematica scientia,Series A, 2014, 34(5): 1161-1172. |

| [11] | HU Feng-Qing. Optimal Excess of Loss Reinsurance for a Correlated Risk Model with Thinning-Dependence Structure [J]. Acta mathematica scientia,Series A, 2013, 33(2): 317-326. |

| [12] | ZHANG Xin-Li, SUN Wen-Yu. Optimal Proportional Reinsurance and Investment with Transaction Costs and Liability [J]. Acta mathematica scientia,Series A, 2012, 32(1): 137-147. |

| [13] | WANG Chun-Wei, YIN Chuan-Cun. Optimal Dividend Strategy in |the Perturbed Compound Poisson Risk Model with Investment [J]. Acta mathematica scientia,Series A, 2011, 31(6): 1567-1578. |

| [14] | WANG Chun-Wei, YIN Chuan-Cun. On the Perturbed Compound Poisson Risk Model under Absolute Ruin with Debit Interest and a Constant Dividend Barrier [J]. Acta mathematica scientia,Series A, 2010, 30(1): 31-41. |

| [15] | LIU Juan, XU Jian-Cheng. Moments of the Discounted Dividends and Related Problems in a Markov-dependent Risk Model [J]. Acta mathematica scientia,Series A, 2009, 29(5): 1390-1397. |

| Viewed | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

Full text 193

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

Abstract 73

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

Cited |

|

|||||||||||||||||||||||||||||||||||||||||||||||||

| Shared | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Discussed | ||||||||||||||||||||||||||||||||||||||||||||||||||

|