| 1 |

Black F , Scholes M . The pricing of option and corporate liabilities. Journal of Political Economy, 1973, 81 (3): 637- 654

doi: 10.1086/260062

|

| 2 |

Cheridito P . Arbitrage in fractional Brownian motion models. Finance and Stochastics, 2003, 7 (4): 533- 553

doi: 10.1007/s007800300101

|

| 3 |

Cheridito P . Mixed fractional Brownian motion. Bernoulli, 2001, 7 (6): 913- 934

doi: 10.2307/3318626

|

| 4 |

Magdziarz M . Black-Scholes formula in subdiffusive regime. Journal of Statistical Physics, 2009, 136, 553- 564

doi: 10.1007/s10955-009-9791-4

|

| 5 |

Gu H , Liang J R , Zhang Y X . Time-changed geometric fractional Brownian motion and option pricing with transaction costs. Physica A, 2012, 391, 3971- 3977

doi: 10.1016/j.physa.2012.03.020

|

| 6 |

Guo Z D , Yuan H J . Pricing European option under the time-changed mixed Brownian-fractional Brownian model. Physica A, 2014, 406, 73- 79

doi: 10.1016/j.physa.2014.03.032

|

| 7 |

Shokrollahi F , Kiliçman A , Magdziarz M . Pricing European options and currency options by time changed mixed fractional Brownian motion with transaction costs. International Journal of Financial Engineering, 2016, 3, 1- 22

|

| 8 |

Shokrollahi F . The evaluation of geometric Asian power options under time changed mixed fractional Brownian motion. Journal of Computational and Applied Mathematics, 2018, 344, 716- 724

doi: 10.1016/j.cam.2018.05.042

|

| 9 |

Bertoin J . Lévy Processes. Cambridge: Cambridge University Press, 1996

|

| 10 |

Sato K I . Processes and Infinitely Divisible Distributions. Cambridge: Cambridge University Press, 1999

|

| 11 |

Samko S G , Kilbas A A , Maritchev D I . Integrals and Derivatives of the Fractional Order and Some of Their Applications. Amsterdam: Gordon and Breach Science Publishers, 1993

|

| 12 |

姜礼尚. 期权定价的模型和方法. 北京: 高等教育出版社, 2004

|

|

Jiang L S . Model and Method of Option Pricing. Beijing: Higher Education Press, 2004

|

| 13 |

Mao Z J , Liang Z A . Evaluation of geometric Asian power options under fractional Brownian motion. Journal of Mathematical Finance, 2014, 4, 1- 9

doi: 10.4236/jmf.2014.41001

|

| 14 |

Rao B L S . Pricing geometric Asian power options under mixed fractional Brownian motion environment. Physica A, 2016, 446, 92- 99

doi: 10.1016/j.physa.2015.11.013

|

| 15 |

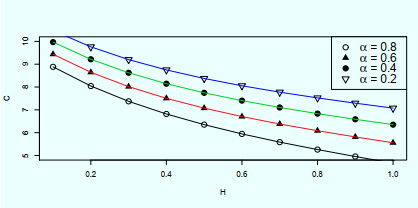

郭精军, 宋彦玲. 基于时间变换和分数型过程下的期权定价及模拟分析. 应用概率统计, 2020, 36 (1): 59- 68

|

|

Guo J J , Song Y L . Option pricing and simulation analysis based on time transformation and fractional process. Applied Probability and Statistics, 2020, 36 (1): 59- 68

|

| 16 |

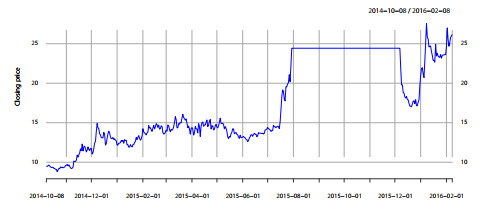

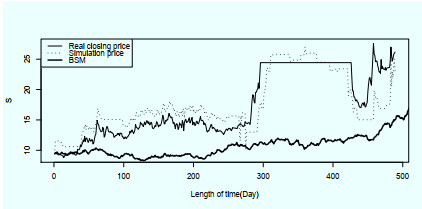

彭波, 郭精军. 在跳环境和混合高斯过程下的资产定价及模拟. 山东大学学报(理学版), 2020, 55 (5): 105- 113

|

|

Peng B , Guo J J . Asset pricing and simulation under the environment of jumping and mixed gaussian process. Journal of Shandong University(Science), 2020, 55 (5): 105- 113

|

| 17 |

杨朝强. 一类特殊混合跳扩散Black-Scholes模型的欧式回望期权定价. 数学物理学报, 2019, 39A (6): 1514- 1531

|

|

Yang Z Q . Pricing European lookback option in a special kind of mixed jump-diffusion Black-Scholes model. Acta Math Sci, 2019, 39A (6): 1514- 1531

|